Building Block: Executive Summary

Content

- A few Executive Summary examples widely used in business presentations-

- Meetings worth showing up to

- Join 446,005 entrepreneurs who already have a head start.

- Making your executive summary work

- IBM: Cost of a Data Breach Report 2020

- What should be included in an executive summary?

- Learn how to create a strong executive summary for your business plan

There is no set order of appearance of the different key items included, quite the contrary, in fact— so use the order to show emphasis. I know experts who recommend a single page, just a page or two, no more than five, and sometimes even longer.

Here, the report explains the collected data, sources of information, and the extent of analysis. This component defines the activities and steps involved in gathering relevant information and analyzing the data. Here is an example of an executive summary slide that can be effectively used for product launch. When you are planning to launch a new project or a product, executives are very anxious to know the launch plan and how it connects with the product strategy. They want to know what would be done before launch, at launch, and post-launch. As you might imagine, this is quite a handful and can quickly become overwhelming.

A few Executive Summary examples widely used in business presentations-

The objectives of the presentation decide the key components of the executive summary. An Executive summary summarizes the intent of the entire business deck in a concise form. Owadays, it is challenging to grab the attention of business executives. With jam-packed schedules, https://wave-accounting.net/ quick decisions to make, and not much time to spare, the executives are always looking for value for their time. Hence the need for the Executive Summary to capture the attention of the busy audience by providing the gist of the entire presentation engagingly.

Executives have a continual, recurring need to review the state of business or key programs in the form of “Business review” presentations. These reviews are necessary to keep them posted on the numbers, progress, challenges, plan, key changes, deviations, risks, and mitigation. As you might imagine, it is easy to drown anyone in detail, with this extent of information needs. When starting a project or even to keep people reminded of the focus and highlights of your project, a project charter style summary is a great format. Minimalistic, well-organized graphics give an immense professional appeal to such documents. After doing thorough research, we have found some things to keep in mind while writing an executive summary. These are our tried and tested tips that will help you create an executive summary that is going to steal the show.

Meetings worth showing up to

You can also download our 300+ free business plan templates covering a wide range of industries. The point is to note all the important points of your executive summary. You will write the headings as well as the description for each heading in only one sentence. The most important information should appear at the top of your executive summary. You should begin with the most important item and follow up with items in order of importance.

- When you’re working on this paper, avoid phrases “the best decision”, “world-class economy”, “cutting-edge technology”, etc.

- If the document is more conversational, then the executive summary should be conversational as well.

- Team Meetings GuideLearn how the world’s best companies run effective team meetings – featuring insights from Figma, Buffer, Close, Webflow, Shopify, and more.

- Sales Performance Transform your business, starting with your sales leaders.

- Keep all of the project stakeholders in the loop with this project management summary template.

- A fresh executive summary based on the points taken from the existing one is the goal of this exercise.

Background problem — The summary’s background problem defines the reason for the report. For example, “investigating the level of consumer demand in the electric vehicle market.” What makes this interesting is that the audience can get a sense of discovery while they see this document by finding interesting tidbits of information. Except in those rare situations just mentioned, in most cases, you will benefit from including executive summaries in your presentations. Here is a list of some scenarios where executive summaries can be immensely powerful in driving your point home.

Join 446,005 entrepreneurs who already have a head start.

Doing so ensures that all interested parties can find any and all information they need in one space. If they have additional questions, they’ll be able to reach out with ease based on the information you’ve What Is An Executive Summary? How To Write An Executive Summary Plus Executive Summary Templates provided. Your goal is a compelling story with only essential information, in the interest of capturing the reader’s attention quickly. Executives have multiple priorities competing for their attention.

Automotive Night Vision System Market to Record a CAGR of 9.19%, Autoliv Inc. and Denso Corp. Among Key Vendors – Technavio – PR Newswire

Automotive Night Vision System Market to Record a CAGR of 9.19%, Autoliv Inc. and Denso Corp. Among Key Vendors – Technavio.

Posted: Mon, 03 Oct 2022 20:00:00 GMT [source]

During this section, you should grab your reader’s attention and tell them what you do and why they should read the rest of your business plan or proposal. An executive summary should be brief, usually just one or a few pages long. If your reader has questions, they can read the details in the proposal or business plan. As a rule of thumb, the length of your executive summary should be between 5-10% of the full report or proposal. An executive summary is the introductory section of a business plan that showcases key information about the business. An executive summary offers an overview of your business at a glance and should be designed to entice the reader to learn more.

Making your executive summary work

For example, a startup plan may contain a description of your product or service, financial projections, key business metrics such as revenue growth, and your funding request. It not only saves time and reduces stress, and saves money on paper and printing costs because all of your board’s materials live in the cloud. While it’s normal to want to write your business plan from beginning to end, it’s best to write the executive summary last. This allows you to flesh out the details in the main section of the document, and you can use that to find the most important points to include in the summary.

- Easily write a business plan, secure funding, and gain insights.

- But a brief report that clearly states your key findings and what’s in it for them might help you — and your proposal — stand out.

- You can repurpose this template and save it as a customized PDF summary memo to land your next meeting with investors.

- We want to do market research, create products or services that solve problems, identify stakeholders, and get the go-ahead to start our project.

- When you’ve been working on a document for too long, it’s easy to be too immersed in the project.

- Use bullet points and clear, formal language to guide the reader to the most important information about your company.

- This executive summary is meant for a wider audience and has likely been reused for many different purposes.

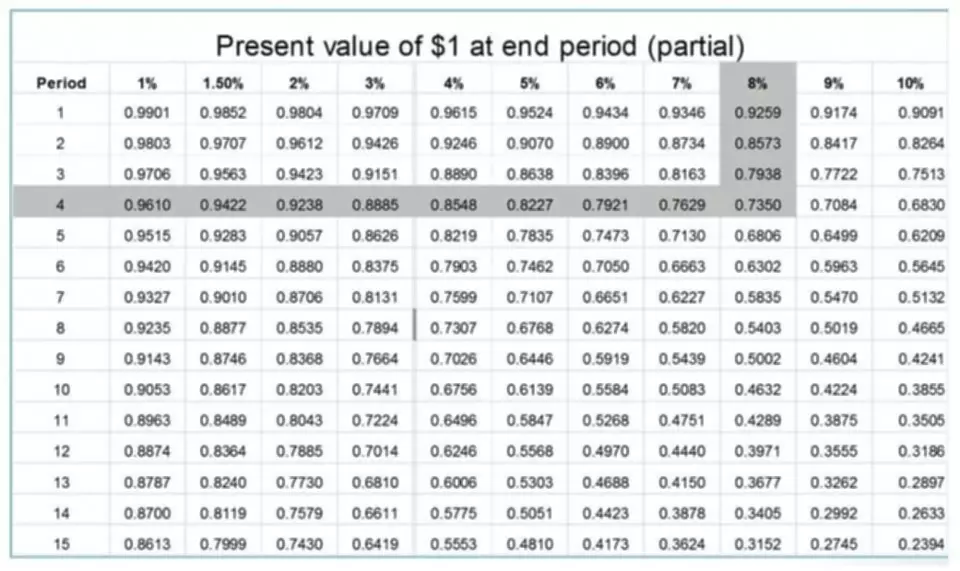

They do not want to read the same standard phrases about guaranteed success. If you have that perspective in your plan, they will see it for sure. Methods of analysis – Methods of analysis include trend, horizontal and vertical analyses as well as ratios such as Debt, Current and Quick ratios. Other calculations include rates of return on Shareholders Equity and Total Assets and earnings per share to name a few.

Most likely, they don’t have the time to read a 100-pages-long project overview or a detailed financial analysis. They need a shortened version to help them understand the most important issues and decide whether or not to do business with you.